Debt Settlement Plan (DSP)

A new plan introduced by LPPSA to recover and settle the civil debt of customers who leave the service or retire without pension through the rescheduling of financing repayments.

DSP is eligible to be applied for by military personnel who have retired without a pension (terminating service according to a short period of time) or civil servants who have left the service.

This DSP plan is not eligible for borrowers:

- Insolvent/bankrupt status

- The property has been auctioned

- Insolvent/bankrupt status

- The property has been auctioned

This DSP plan can be applied for from 1 October 2022

Refer to DSP 1 or DSP 2 application and approval requirements

Refer to DSP 1 or DSP 2 approval terms

Account eligibility details can be checked via LPPSA hotline at 0388801600 or through the Official LPPSA Inquiries/Complaints Portal at https://etiket.lppsa.gov.my

Eligible to apply for DSP 2

Applications can be made through the LPPSA Online Portal as linked https://services.lppsa.gov.my/dsp/

For the purpose of repayment of financing, payment must be made using the CIMB Virtual Account number (VA) 98 << VAACTNO >> which is reserved for borrowers through the method listed below:

3.1 Cash at CIMB Counters throughout Malaysia, or;

3.2 Online through IBG, IBFT, RENTAS, Maybank2U or CIMBClicks, or;

3.3 CIMB Bank self-service machines – ATMs and Cash Deposits.

The payment procedure (E-payment) can be referred to the link https://myfinancing.lppsa.gov.my/my/e-bayaran

3.1 Cash at CIMB Counters throughout Malaysia, or;

3.2 Online through IBG, IBFT, RENTAS, Maybank2U or CIMBClicks, or;

3.3 CIMB Bank self-service machines – ATMs and Cash Deposits.

The payment procedure (E-payment) can be referred to the link https://myfinancing.lppsa.gov.my/my/e-bayaran

Yes. Heirs or family members can make payments through the procedures mentioned above (item 10) or through the link:

https://myfinancing.lppsa.gov.my/my/e-bayaran

https://myfinancing.lppsa.gov.my/my/e-bayaran

Yes, this DSP plan retains the original insurance coverage.

Customers are advised to discuss with LPPSA hotline at 0388801600 or through the LPPSA Official Inquiry / Complaint Portal at https://etiket.lppsa.gov.my

Yes, refinancing can be done. However, monthly instalments payment must continue until full settlement is made on the remaining LPPSA financing debt

Yes, an application must be made for rescheduling at the rate of 4% per year.

You are advised to first consult with the Malaysian Insolvency Department (JIM).

Yes. You can apply for a DSP plan and continue the monthly payment instalments.

Yes. The withdrawal of instalments on the demand of the developer or contractor will continue until the entire payment is made including the premium for the Long Term Home Owners Policy (LTHO).

| CRITERIA | DSP 1 | DSP 2 |

|---|---|---|

| APPLICANT REQUIREMENTS | ||

| Eligibility |

|

|

| APPROVAL REQUIREMENTS | ||

| Account Status |

|

|

| Application Period |

|

|

| Mandatory Documents |

|

|

| TERMS OF APPROVAL | ||

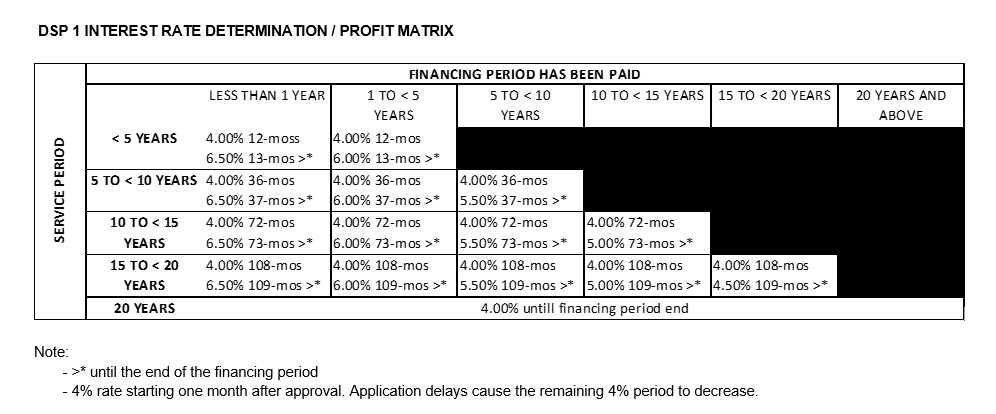

| Interest Rate/Profit |

|

7% per year until the end of the financing period |

| Repayment | Monthly installments begin one month after approval | Monthly installments start one month after approval |

| Original Financing Period | Unchanged | Unchanged |

| Other Financing Conditions | Unchanged | Unchanged |